The banking value chain is rife with opportunities for digital transformation. Over the next decade, many large banks will deploy dozens (if not hundreds) of enterprise AI software applications to capitalize on opportunities to grow revenue, increase operational efficiency, and mitigate risk. The value of AI in banking — worth around $250 billion annually, according to McKinsey Global Institute — will be captured across many use cases in retail and commercial banking, including both front and back office operations.

Figure 1: The banking value chain presents a wide selection of AI use cases

However, this $250 billion pot will not be split proportionally among all financial services institutions. Only banks that successfully navigate the myriad challenges on the path to digital transformation will reap these benefits. Those that don’t, or that never embark on the digital transformation journey at all, will be stuck with unusable and rigid technology and will be easily outmaneuvered by banks with agile AI capabilities. Read on to learn about three mistakes that many banks inevitably will make, but that can be avoided.

Mistake 1: Hiking Everest with a Fanny Pack

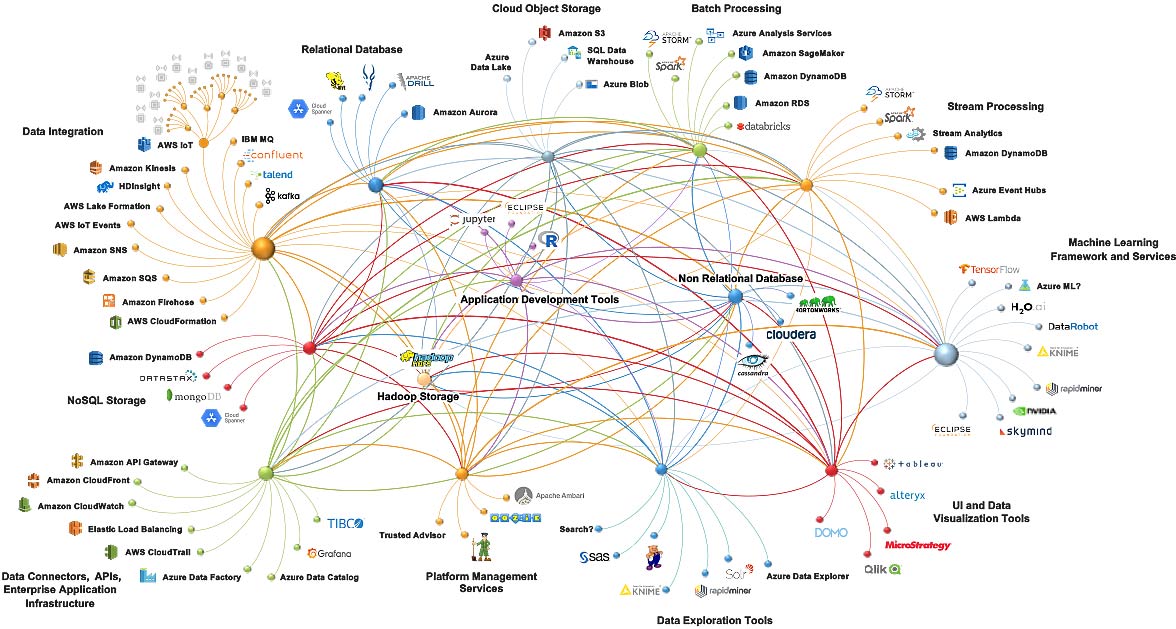

Some banks will fail to transform their business simply because they’ll underestimate how extraordinarily complex enterprise AI is. They will, naively, assume that their existing software strategy and processes are sufficient to accommodate AI. But, as Everest is not just another hike, AI is not just another technology. To succeed in building do-it-yourself enterprise-scale AI systems, a typical company must integrate dozens of open-source and third-party services. To be successful, these tools must come together seamlessly to resolve data ingestion, transformation, persistence, virtualization, and processing challenges – not to mention the challenges involved in developing, deploying, monitoring, and operating thousands (if not millions) of machine learning models. Traditional software development processes and technology stacks are not sufficient.

Figure 2: Complexity in the open-source AI tech stack

When deploying AI applications at a bank, complexity increases by an order of magnitude over the typical enterprise. Not only do regulations require banks to comply with higher security and reliability standards, at C3.ai we’ve seen five additional areas that materially complicate the AI stack for banks:

- Auditability: For compliance purposes, a bank must be able to reproduce any model, prediction, or analytic generated by any AI application. These regulations include complex requirements not only to track prediction lineage, application dependencies, and data flows but also to enable “time travel” – the ability to replay history and demonstrate how each AI insight was generated to prove the process’s validity.

- Fairness: Any AI application affecting bank clients must be designed, built, and thoroughly validated to ensure fairness and avoid bias towards protected customer segments.

- Transparency: All AI algorithms must be interpretable to promote transparency, improve usability, and demonstrate fairness. So-called “black box” algorithms cannot be used in many banking applications.

- Monitoring and management: Given the high-stakes nature and fast-evolving reality of financial markets, AI applications must be deployed with robust, fail-proof model management frameworks to automatically monitor, validate, retrain, and shut down live AI models as necessary.

- Hybrid cloud: As more banks move toward public or virtual private cloud solutions, exclusively on-premise solutions fall short. AI technology stacks must enable cloud and hybrid-cloud deployments for banking.

Over the next few years, many banks will outright fail to get disparate technologies to work together within the standards that financial institutions require. Many will realize too late that they dramatically underestimated the challenge. Others will make it to base camp – successfully developing a small handful of brittle AI solutions – but will struggle to scale horizontally. Only an elite few will recognize the looming complexities of the task at hand and properly adjust their strategies, processes, and commitments to reach the summit of artificial intelligence successfully.

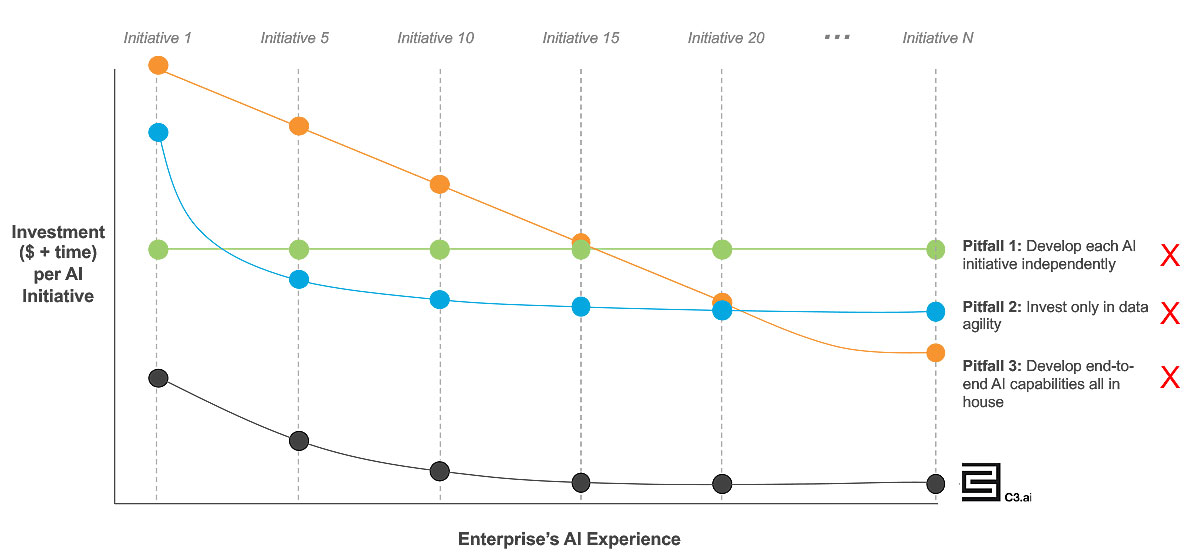

Mistake 2: Pursuing High-Hanging Fruit

Some banks will fall behind because of poor planning and lack of a diligently crafted AI roadmap. They’ll be tempted only to prioritize big, flashy AI use cases, passing up low-hanging fruit on the way. Or they’ll pursue “easy” AI initiatives only to find out they are not, in fact, easy at all. These tactical mistakes result in lost momentum and weakened commitment to AI adoption. Banks that succeed will prioritize strategic use cases that build enterprise-wide momentum and enthusiasm for AI adoption. To succeed, banks must answer three fundamental questions for each AI initiative:

- Is it viable?

- Is it valuable?

- What priority should it receive relative to other planned AI projects?

Viability

Some banks will stumble because they fail to assess both the technical and the political viability of an AI use case. To avoid these pitfalls, leaders should examine:

- AI Tractability: Is there a reasonable expectation that an AI model can use the available data to resolve the question or decision of interest? Can the initiative be delivered with a simple, interpretable, fair, and bank-compliant AI model? Once deployed, how resilient will the model be and how much monitoring and upkeep will it require?

- Internal Advocacy: Does this initiative have strong advocates? Will both business and technology leaders sustain commitment to its success?

Value

Many banks will become disillusioned with AI initiatives if they fail to take into account the full scope of costs and benefits associated with each project. Before moving ahead, leaders should assess:

- Value: What are the potential economic and strategic benefits of deploying this AI initiative? How scalable is that value across the enterprise?

- Data synergy: Can this initiative reuse existing data and other AI assets? Would this initiative create new data assets that could be reused in subsequent projects?

- Development effort: Will this initiative augment existing applications, or does it require building new applications?

- Change management effort: What is required to develop new business processes, retrain employees, or promote end user adoption?

Priority

Even if all use cases have been properly assessed, it would be a costly mistake to prioritize only those initiatives deemed to be of the highest value. AI is a marathon, not a sprint. Banks should balance their priorities carefully between ambitious, high-value projects and quick wins – low-cost, highly viable projects that may or may not be considered highly valuable. With too many big AI projects and no quick wins to celebrate, a bank risks enterprise-wide fatigue, disillusionment, or frustration with AI. But with no big projects to pursue, a bank risks being outmaneuvered by competitors in the arenas carrying the highest stakes.

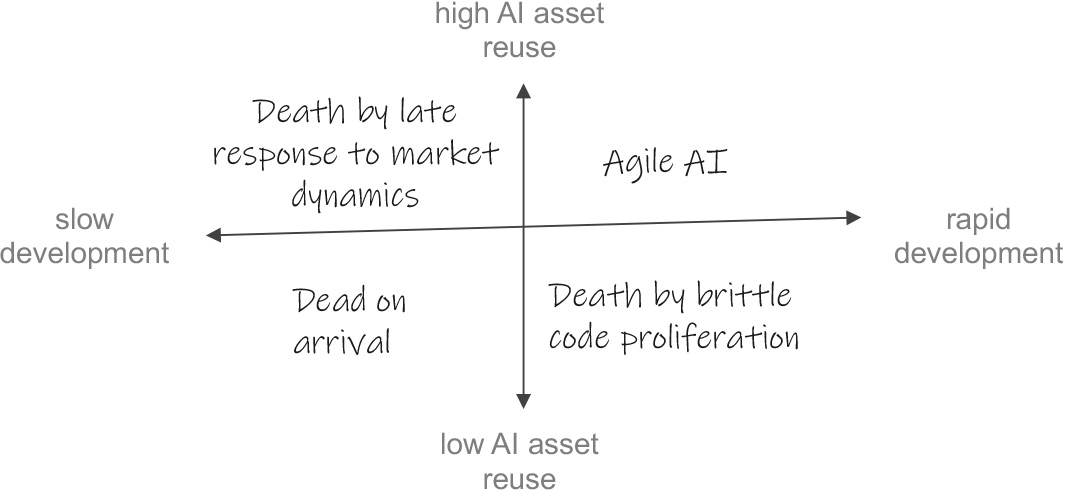

Mistake 3: Sledding Down Moguls

Banking has hundreds of AI use cases in the front and back office, commercial and retail sectors, and in both private and public markets. Additionally, banking is a highly dynamic market with fast evolving customer needs. Banks that are fastest off the starting line to deliver a flashy AI solution will not be the ultimate winners of the race to capture AI value. Instead, the winners will be banks that execute a strategy that enables rapid response to fast-changing market dynamics, including the ability to quickly deliver their fiftieth and hundredth AI initiatives as new business needs are identified. Banks that don’t invest in the skills and tools that enable this kind of AI agility will find AI to be bumpy, tedious terrain.

Any bank strategy optimizing for AI agility must consider two key issues:

- How will we enable more rapid development of net-new data and AI assets?

- How will we ensure that every data and AI asset developed for any AI initiative is extensible and reusable across future projects? How will we eliminate redundant development of common elements of the AI tech stack?

Banks that successfully navigate these issues will become AI agile. Banks that don’t inevitably will fall behind.

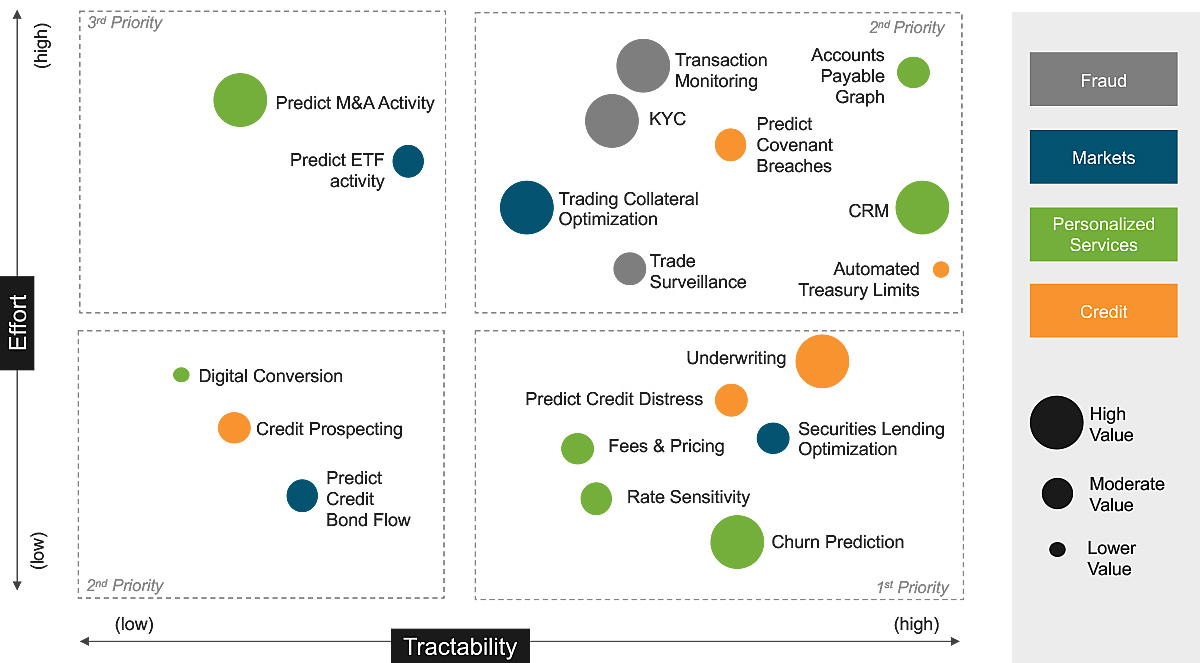

Figure 3: AI Agility in Banking

At C3.ai, we’ve engaged with many banks pursuing divergent AI adoption strategies. Some adopt partner or vendor strategies while others seek to build everything in-house. Some make big, up-front investments in AI while others approach digital transformation more cautiously. Here are some of the most common AI strategy pitfalls that we’ve seen:

Pitfall number 1

Develop each AI initiative independently. This approach prioritizes short-term efficiencies over long-term AI agility. It mobilizes ad-hoc and disparate teams to attack each AI problem but does not implement a centralized strategy to accelerate development or to create and distribute reusable data and AI assets.

This approach is tempting because it’s relatively low-cost and provides the shortest time to value. It feels pragmatic; there is no centralized overhead so fewer people can deliver the first initiative quickly.

Pitfall number 2

Invest only in data agility. With a “build it and they will come” attitude, this strategy centralizes data (e.g., by building a data lake), publishes data assets across the bank – then waits for separate functions or business units to come implement independent AI initiatives on top of that data foundation. No further centralized effort is made to enable an end-to-end integrated agile AI capability. This approach adds a costly upfront step to pitfall number 1, meaning it may take the bank longer to deliver its first initiative.

Pitfall number 3

Develop end-to-end AI capabilities in-house. In this approach, a bank invests heavily in cobbling together dozens of open-source and third-party point solutions to deliver an internal do-it-yourself platform for data centralization and AI development. The bank establishes an internal team to centralize all AI development and upkeep effort, sustaining investment over time until AI agility is achieved.

This approach is tempting because it has the potential to reduce dramatically the marginal cost of developing incremental AI initiatives. But this is also the riskiest strategy. Like enterprises in the 1980s that built in-house databases, only to rip out their bad technology later and replace it with Oracle RDBMS, building end-to-end AI capabilities in-house is likely to be a costly mistake.

Fortunately, there is a viable path to AI agility in banking:

- Leverage a proven software suite that is purpose-built to enable agile AI at enterprise scale

- Engage the software provider as a strategic partner to help craft an AI roadmap and enable successful delivery

- Use this capability to accelerate delivery of the first AI initiatives while making all data and AI technology assets reusable for subsequent initiatives

This is where C3.ai shines. We believe – and our Fortune 500 banking customers agree – that the next-generation AI software stack in the C3 AI Platform provides an enormous opportunity for banks to reap the long-term benefits of AI agility while demonstrating rapid, near-term value from the start.

Figure 4: AI Agility Over Time in Banking

Banking’s Road to Success in AI

So how are successful banks addressing these challenges today? At C3.ai, we’ve engaged with many banks at every stage of the digital transformation journey. Many have engaged C3.ai after trying and failing to use in-house tools to deploy a first AI application to production. Others have come to us after building a first use case before realizing that their current approach is not sufficient to enable truly rapid AI development and deployment. Some, using the C3 AI Platform, have successfully built and deployed their first set of transformational AI applications and are assessing a long queue of future AI use cases for development. These latter banks are charging confidently ahead with an ambitious roadmap of AI initiatives.

Figure 5: Hypothetical Banking Roadmap for AI Initiatives (based on C3.ai engagements)

Over the next decade AI will transform every major banking function. For breakout banks – those that successfully navigate AI development complexity, carefully prioritize an AI roadmap, and successfully develop agile AI capabilities – this will be a decade of extraordinary opportunity.